Will AI Replace Accountants?

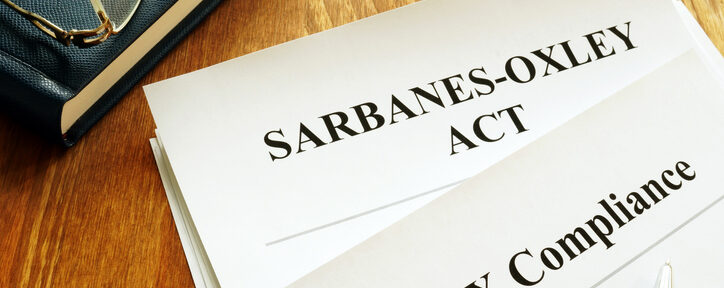

Artificial intelligence is transforming the accounting profession with unprecedented speed and scope. For current practitioners and those pursuing accounting careers, the fundamental question emerges: will AI replace accountants, or will this technological evolution create new professional opportunities? The evidence suggests …

posted in Accounting News